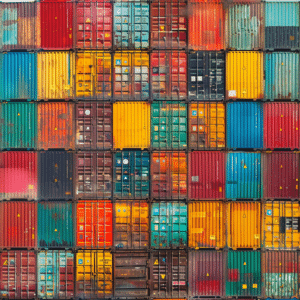

Surely, you’ve seen stacks of shipping containers at busy ports, but have you ever considered them as an investment opportunity?

In the rapidly evolving world of investments, shipping containers can be an unconventional but profitable venture. You could be tapping into a global shipping industry worth billions, especially since it was also affected by big data positively.

But, as with all investments, it’s not without risks. You’ll need to understand the market, identify potential pitfalls, and navigate tax complexities.

Ready to explore this off-the-beaten-path investment?

Investing in Shipping Container Stocks

Diving into the realm of shipping container stocks can offer you a unique investment opportunity. You might be used to traditional investments, but it’s time to consider the shipping container market.

Just like you’d invest in the tech or real estate sectors, you can also put your money into shipping container investments. This sector is booming, and it’s not just about the physical containers, although the market is huge – nearly anyone can put a shipping container on his property. Container stocks can be a profitable investment due to the high demand for transporting goods worldwide.

But how do you start investing in shipping? First, you’ll need to familiarize yourself with the shipping container market. Understanding its trends and predicting its future movements are key to making a successful container investment.

Next, you’ll need to identify the container stocks with the best return on investment. This involves researching various companies, analyzing their financial health, and evaluating their future prospects. And knowing how to calculate an ROI, of course.

The Benefits

Now, you might be wondering why you should choose shipping container stocks over traditional investments. After all, traditional investments such as stocks and bonds have been around for centuries, right? But that’s just it, they’re traditional, and as the global economy evolves, so should your investment strategy.

Consider this: the shipping container industry comes with numerous benefits and it’s positively booming. It’s an essential cog in the global economy, facilitating international trade. By investing in this sector, you’re tapping into a vast, dynamic market. Here’s where shipping container investment comes in. You can either buy shipping containers or go the route of leasing shipping containers. Both methods offer you opportunities to earn passive income.

Now, you’re not just buying or leasing any old box. These are money-making machines. They’re leased out, filled with goods, and sent around the world. Each trip they make, each lease they secure, it’s money in your pocket. Plus, by investing in shipping container stocks, you’re not tied down to a single container. You’re investing in a fleet, in a company, in an industry. So, if you’re looking for a new avenue for investment, container leasing might just be the ticket. It’s a non-traditional investment with traditional money-making potential.

Tax Incentives and Disadvantages of Investing in Shipping Containers

While you’re considering the benefits of investing in shipping containers, it’s also important to understand the tax incentives and potential disadvantages that come with this type of investment. Tax incentives are often a significant factor in container investments. They can reduce your tax liability, making your investment more profitable. However, these incentives vary by location and the specifics of the investment.

One of the disadvantages of buying shipping containers is the maintenance costs. You’re responsible for the upkeep of your containers, which can be pricey. Additionally, leasing containers can present risks. If the lessee defaults or the containers are damaged, you’re left to shoulder the financial burden.

Furthermore, the shipping container market can be volatile, which presents another risk. Changes in global trade patterns and economic downturns can significantly impact your investment.

Tax Incentives

Let’s explore the potential tax incentives that can make investing in shipping containers more lucrative for you. The government often offers tax incentives to encourage investments in certain sectors, and shipping containers might be one of them. These incentives can significantly increase your profit margin and make your business more viable.

For instance, you may be eligible for capital allowances. This means you can deduct the cost of acquiring the shipping containers from your taxable income, thereby reducing your tax liability. In some jurisdictions, there are also investment tax credits available for investors in the shipping container business. These credits can offset a portion of the income tax you owe.

There might also be opportunities to depreciate your shipping containers over time. This allows you to spread the cost of your investment over several years, further decreasing your taxable income.

However, it’s crucial to note that tax laws vary by country and region. Therefore, you should consult with a tax professional to fully understand the potential tax incentives available to you. Investing wisely in shipping containers can benefit you immensely, but it’s essential to understand the tax implications to maximize your returns.

Buying or Leasing Shipping Containers

Deciding whether to lease or buy shipping containers is a crucial step in your investment journey. Both options have their benefits, but it largely depends on your individual investment goals and financial situation.

Buying shipping containers can be a good investment, as the high demand for these containers often leads to a profitable resale value. It’s an upfront purchase, but the long-term payoff can be significant. You’re essentially purchasing a tangible asset that you can sell when the market is favorable.

On the other hand, leasing shipping containers can provide you with a steady stream of rental income. You won’t own the containers, but you’ll earn income from the lease agreement. It’s a lower-risk option that can be particularly attractive if you’re not in a position to make a large initial investment.

In both scenarios, it’s essential to research and understand the market dynamics. Remember, any form of investment comes with its risks. Whether you decide on buying or leasing shipping containers, ensure you’re making an informed decision that aligns with your investment strategy. In the end, the choice is all about what best suits your financial goals and risk tolerance.

Special Considerations for Product Companies

For product companies considering investing in shipping containers, there are unique factors to consider that can significantly impact your bottom line. It’s not just about buying or leasing containers; it’s about understanding the nuances of the shipping industry and making strategic decisions that align with your company’s objectives.

Firstly, determine the container types that best suit your product needs. Are you shipping perishables or non-perishable goods? This decision affects your investment and ultimately, your company’s value.

Next, consider the pace at which you’re planning to expand. Investing in a large number of containers at once may not be profitable if you’re not utilizing them fully. This is where leasing might be a better option.

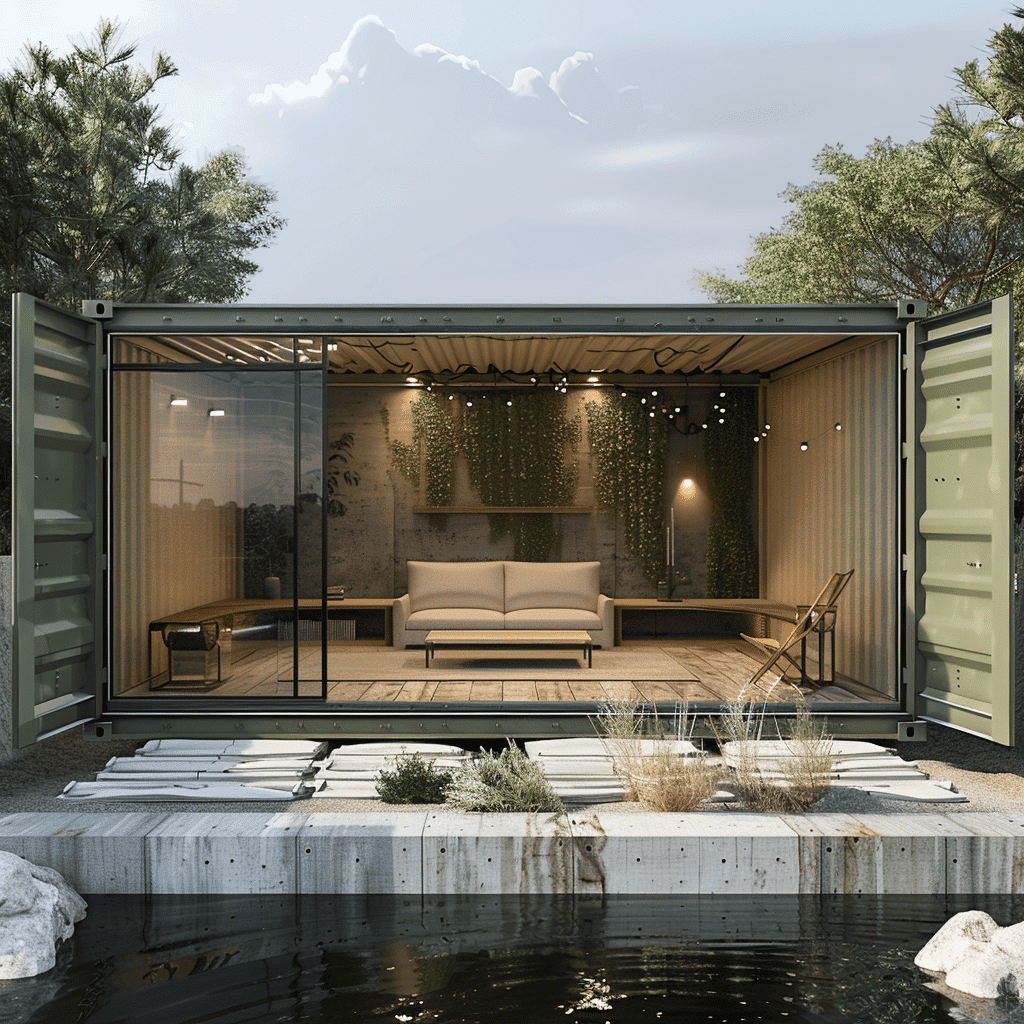

Also, remember that shipping companies aren’t your only potential clients. There’s a growing market for selling equipment to individuals who wish to convert them into a shipping container home. This can increase the value of your investment.

Lastly, keep an eye on the market trends. The value of your investment can fluctuate with changes in the shipping industry. A downturn might mean lower returns, but an upturn could present opportunities for greater profits. Make sure you’re prepared for both.

Tips

Choosing the right containers and ensuring their quality is a crucial step in maximizing your shipping investment. It’s vital to understand the shipping industry’s dynamics and how to effectively select containers. You can’t simply buy any container and expect a good return.

Firstly, consider the functional value of a container. It should be robust, weather-resistant, and secure. Look for reliable suppliers with a solid reputation in the industry. They’re more likely to sell containers that meet these criteria.

New containers tend to offer better quality and longevity. However, you’ll pay a premium for them. If you’re on a tight budget, you can consider used containers, but make sure they’re in good condition and have been properly maintained.

Never underestimate the importance of proper maintenance. It extends the life of your containers, maintains their functional value, and helps to preserve your investment.

When you’re ready to sell containers, their condition will significantly impact their value. So, it’s worth investing in their upkeep.

Avoiding Foreign Shipping Container Scams

Navigating the world of foreign shipping container investments, it’s crucial you’re aware of potential scams and know how to avoid them. In this globalized world of trade, shipping containers are vital assets in operations, but they can also be a trap for unsuspecting investors.

When you’re about to invest in shipping containers, always use reliable platforms. Go for established shipping transportation services with solid reputations. They’re less likely to engage in fraudulent practices and more likely to be regulated. Don’t rush into buying from just any company selling containers; instead, do your homework.

It’s also important to know where to find containers. Don’t be swayed by unusually cheap offers. As the saying goes, if it seems too good to be true, it probably is. Be wary of sellers who push hard for quick sales decisions or those who demand upfront payments.

Common Scam Tactics

In the ever-changing landscape of shipping container investments, it’s crucial you’re equipped to recognize common scam tactics. Scammers often exploit the allure of one trip containers, presenting them as a smart move for potential investors. These containers, used only once, are touted as being in pristine condition and thus, are sold at a higher price.

Be aware of this; a higher price doesn’t always equal better quality. Unscrupulous sellers may falsely claim their wares are one trip containers, inflating the cost while providing subpar products. This is especially prevalent with shipping container homes, a market seeing current demand on a global level.

Another tactic is manipulating the perceived value of the containers. Here, fraudsters create a sense of urgency, insisting the buyers must act now to secure a good deal. They hype up the demand and underplay the supply, pressuring you into paying more than you should.

Understanding these tactics is a crucial first step towards protecting your investment. Stay informed about market trends, be skeptical of too-good-to-be-true deals, and always verify the authenticity of the containers and the credibility of the sellers. It’s your money, after all, and you’ve got every right to ensure it’s spent wisely.

Recommendations for Safe Investment Practices and Avoiding Financial Losses

Now that you’re aware of potential scam tactics, let’s explore some strategies you can use to safeguard your investments and minimize financial risk. Investing in shipping containers can be low risk if you’re careful. To ensure long term success, diversify your portfolio to include a mix of assets. This way, if demand for shipping containers falls, you’ve got other investments to fall back on.

Don’t rush to sell if the market dips. Often, it’s better to hold onto your investment and wait for a recovery. Remember, investing is a marathon, not a sprint. Prioritize your capital; don’t overextend yourself. If you’re constantly worried about your investment, it’s likely you’ve invested too much.

Maintenance of your shipping containers is crucial. Regular checks can prevent minor issues becoming major, costly problems down the line. Also, ensure you’re insured. This can cover any unexpected losses and add an extra layer of protection to your investment.

Don’t forget, risk is part of any investment. But with careful planning and smart strategies, you can mitigate that risk and increase your odds of financial success.

The Importance of Research

Before diving headfirst into the world of shipping container investments, it’s crucial that you do your homework and take stock of your individual financial situation. Remember that investing, whether it’s in refrigerated containers or traditional stock markets, isn’t a one-size-fits-all solution to making money. Chasing the highest compound annual growth rate without considering your personal financial circumstances can lead to unforeseen consequences.

Research is key. Understand the ins and outs of equipment trading, from the price of hard assets to the market’s current trends. Know the difference between standard shipping containers and refrigerated ones. Each has its unique pros and cons, and your choice should align with your financial goals and risk tolerance.

Take into account the volatility of the trading markets. Prices can fluctuate, and while hard assets like shipping containers can provide a buffer against economic instability, they’re not immune to price changes.

In this venture, there’s no substitute for knowledge. Equip yourself with the right information before you take the plunge. Your money is a hard-earned asset, and it deserves to be invested wisely. So, think it through, do your research, and make an informed decision.

Frequently Asked Questions

Are shipping containers a good investment?

Shipping containers are increasingly being viewed as a viable investment option. Their dual value, both in terms of material worth and functional use, makes them an attractive asset. Investors are drawn to shipping containers as they can serve multiple purposes beyond just transportation and storage, including being transformed into homes or commercial spaces. The adaptability and enduring demand for these containers in various sectors underscore their investment appeal.

How profitable are shipping containers?

The profitability of shipping containers can be quite significant. Investors can reap substantial returns by strategically buying containers at lower prices in less demanded areas and selling or leasing them in markets where demand is higher. Additionally, the versatility of shipping containers allows for various income-generating avenues, including their use in the burgeoning industry of container-based living and commercial spaces.

Can you invest in containers?

Yes, individuals can invest in shipping containers in several ways. Direct investment options include purchasing containers to lease or sell. Alternatively, investors can engage in the shipping container market through indirect investments such as buying shares in container companies or container leasing firms. This flexibility in investment approaches enables both direct engagement with the asset and exposure to its market dynamics through financial instruments.

What is the best shipping container stock?

Regarding the best shipping container stock, Kirby Corporation (NYSE:KEX) is highlighted as a prominent player worth considering. Kirby Corporation is recognized within the investment community for its robust performance and strategic position in the shipping and container industry, making it an attractive option for those looking to invest in shipping container stocks.

Conclusion

So, investing in shipping containers can be a game changer. However, it’s crucial to do your homework, understand the risks, and avoid scams. Tax incentives can make it appealing, but remember, there’s no one-size-fits-all investment.

Weigh your options, consider the pros and cons, and make a choice that best suits your financial situation. Investing wisely can lead to significant returns, so don’t rush. Your financial future is worth the time and effort.